24-hour title loans offer swift cash for immediate needs, secured by a vehicle, with approval in a day. Online applications and digital processes streamline the process, requiring proof of ownership, ID, and income. Ideal for emergencies, these loans have shorter terms (30 days-a year) and higher interest rates, emphasizing responsible borrowing to avoid penalties.

“Discover the ins and outs of 24-hour title loans – a swift financial solution for your immediate needs. This comprehensive guide breaks down the process, from understanding the basics to securing same-day approval. Learn how these loans work, who qualifies, and what steps to take for a seamless repayment process. Get ready to access funds fast with our simple guide to 24 hour title loans.”

- Understanding 24-Hour Title Loans: Basics Explained

- Qualifying for Same-Day Approval

- Repayment Process: How to Get Your Loan Fast

Understanding 24-Hour Title Loans: Basics Explained

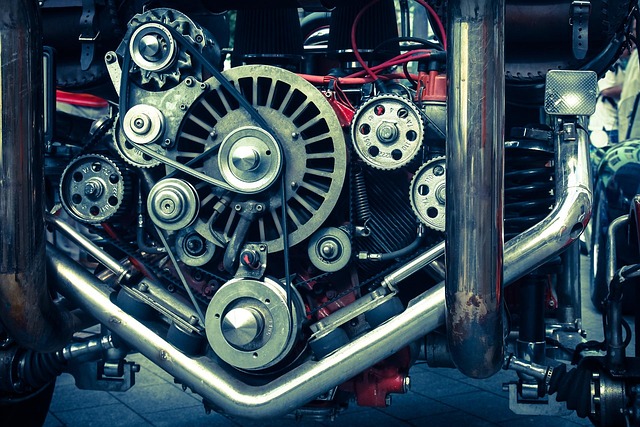

In the world of short-term lending, 24-hour title loans stand out as a convenient and quick financial solution for individuals in need of cash fast. This type of loan is secured by an asset, typically a vehicle, allowing lenders to offer approval within a day. The process involves using your vehicle’s title as collateral, meaning you retain possession of the vehicle while gaining access to immediate funds. This makes 24-hour title loans an attractive option for those seeking a swift financial fix.

Understanding the loan terms is crucial before diving into this arrangement. These loans often come with shorter repayment periods, typically ranging from 30 days to a year, and higher interest rates compared to traditional personal loans. However, given the urgency they cater to, they offer a faster way to secure funds. Loan eligibility criteria vary by lender but generally require proof of vehicle ownership, a valid driver’s license, and a stable income source. As with any loan, it’s essential to weigh the benefits against the potential risks to ensure it aligns with your financial needs.

Qualifying for Same-Day Approval

Getting approved for a 24 hour title loan is quicker than ever before, thanks to streamlined online applications and digital underwriting. Lenders now offer same-day approval, making it possible to secure funding in just a matter of hours. To qualify, borrowers typically need to meet certain basic requirements, such as being at least 18 years old with a valid driver’s license and proof of vehicle ownership. The process begins with an initial online application where you provide your personal information and details about the car you own. Once submitted, underwriters review your application and assess its validity based on established criteria.

If approved, lenders will verify the condition of your vehicle to ensure it meets their standards for collateral. This quick funding option is ideal for unexpected expenses or emergencies, as borrowers can keep their vehicle while accessing much-needed cash. Loan terms typically range from a few months to a year, allowing borrowers to repay the loan at their own pace without sacrificing their vehicle’s value or convenience.

Repayment Process: How to Get Your Loan Fast

When you’re approved for a 24 hour title loan, the repayment process is designed to be swift and straightforward. Lenders understand that time is of the essence when it comes to cash advances, so they’ve streamlined the procedure. Typically, your loan will be disbursed within the same day or, at most, the following business day. Repayment usually begins a few days later, with regular payments made over a set period, often 30 days or less. This flexibility is one of the key advantages of these loans, offering borrowers a manageable way to access much-needed funds quickly.

To ensure a smooth repayment process, it’s essential to have a clear understanding of your loan terms, including interest rates and any associated fees. Keeping track of these details will help you prepare for upcoming payments and manage your finances effectively. Remember, responsible borrowing involves adhering to the agreed-upon schedule to avoid penalties or delays in repaying your 24 hour title loan.

If you’re in need of quick cash, 24-hour title loans could offer a convenient solution. By understanding the basics, qualifying efficiently, and navigating the straightforward repayment process, you can access your funds swiftly. Remember, while these loans can be beneficial for urgent financial needs, it’s crucial to borrow responsibly and plan for timely repayment to avoid potential penalties.